Building a strong credit score is crucial in Canada. It unlocks access to loans, mortgages, and even better insurance rates. But for those with no credit history or a past of missed payments, establishing good credit can feel like climbing a mountain. Fear not, credit seekers! This guide explores the best credit cards for building credit in Canada, helping you navigate the path toward financial stability.

Understanding Credit Building:

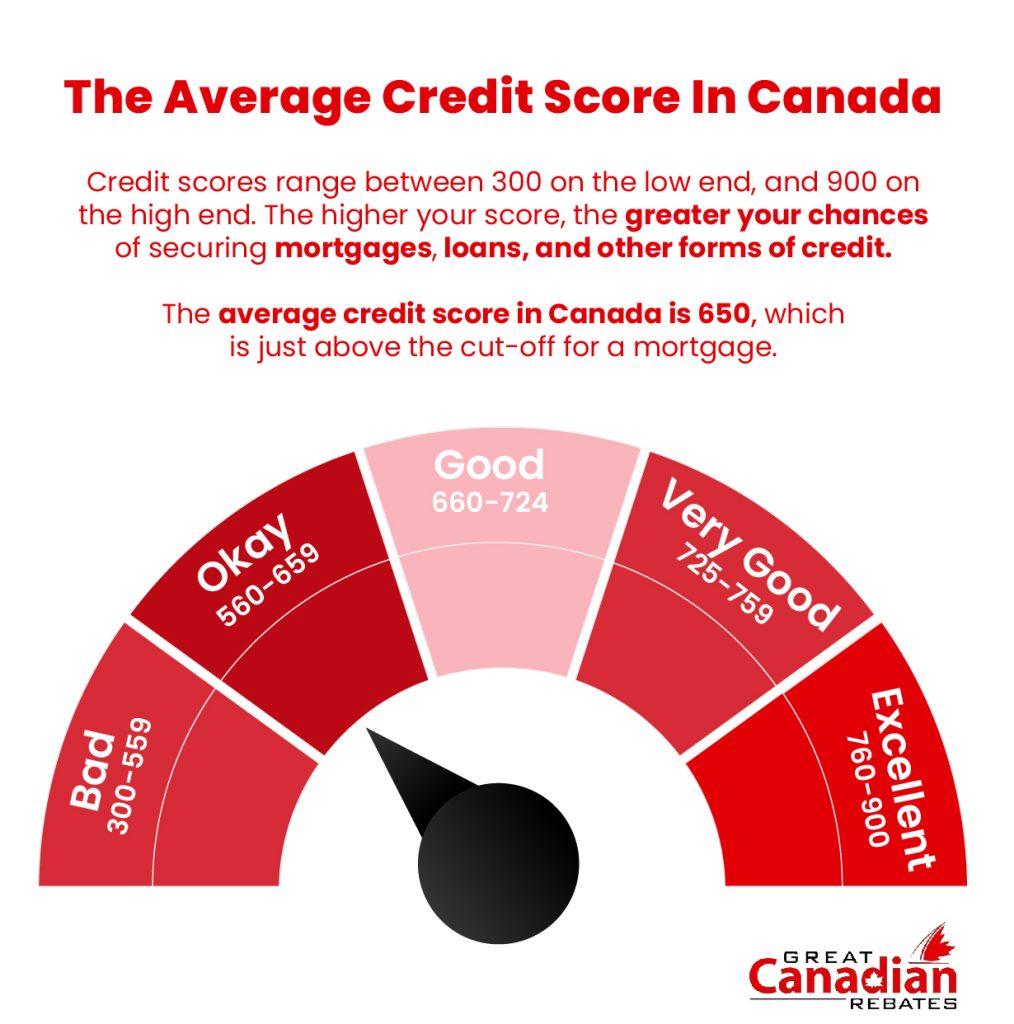

Before diving into specific cash back credit cards, let’s understand how credit cards contribute to your score. Credit bureaus in Canada (Equifax and TransUnion) primarily consider five factors:

- Payment history (35%): This is the most crucial factor. Timely payments on your credit card significantly improve your creditworthiness. Late payments can significantly damage your score, so prioritize paying your balance in full and on time.

- Credit utilization ratio (30%): This refers to the amount of credit you’re using compared to your limit. Keeping this ratio below 30% is ideal. For example, if your credit limit is $1,000, aim to keep your balance below $300. This demonstrates responsible credit management.

- Length of credit history (15%): The longer you’ve had credit accounts (open and managed responsibly), the better it is for your score. Even a secured credit card with a small limit can help establish your credit history.

- Credit mix (10%): Having a healthy mix of credit products (credit cards and loans) can positively impact your score, but it’s not as crucial as the factors above. Once you’ve built a good foundation with a credit card, you can consider exploring responsible loan options in the future.

- New credit inquiries (10%): Frequent credit applications can slightly lower your score in the short term. Be strategic when applying for new credit cards. Don’t submit multiple applications simultaneously.

Secured vs. Unsecured Credit Cards:

There are two main types of the best credit cards for building credit in Canada: secured and unsecured.

- Secured Credit Cards: These require an upfront deposit (usually your credit limit) that serves as collateral. They’re ideal for those with no credit history or bad credit. Your responsible use is reported to credit bureaus, helping you build a positive credit profile.

- Unsecured Credit Cards with Low Limits: These cash back credit cards don’t require a deposit. They’re typically offered to individuals with a decent credit history. Some options include student credit cards (great for young adults) and no-frills credit cards (no rewards, no annual fee, focus on building credit responsibly).

Choosing the Right Credit Card:

- Interest Rates: Secured cards typically have higher interest rates than unsecured cards. However, the focus here is building credit, not accruing interest. Pay your balance in full each month to avoid interest charges.

- Annual Fees: Some secured and unsecured cards with low limits have annual fees. Weigh the fee against the benefits of building credit. Consider starting with a no-fee card and graduating with a rewards card later.

- Rewards Programs: While not the primary focus, some secured and low-limit unsecured credit cards offer cash back or travel rewards programs. These can incentivize responsible card use while building credit. For instance, the Neo Secured Mastercard offers cashback rewards.

Beyond Credit Cards: Additional Tips

Building credit goes beyond just credit cards:

- Become an Authorized User: Ask someone with good credit to add you as an authorized user on their account. Their positive payment history can improve your score. However, ensure they’re a responsible card user, as their missed payments can negatively impact your score.

- Pay Bills on Time: Timely payments on all your bills (phone, utilities) contribute to a good credit history. Setting up automatic payments can help you avoid late fees and missed payments.

- Avoid Maxing Out Your Credit Limits: Keep your credit utilization ratio low by not using more than 30% of your credit limit. This demonstrates responsible credit management.

Building a strong credit score takes time and responsible financial management. By choosing thebest credit cards for building credit in Canada and employing these strategies, you’ll be well on your way to achieving a brighter financial future. Remember, building credit is a marathon, not a sprint! Patience and responsible credit use are key.

Additional Considerations:

While this guide explores some popular options for credit card rebates in Canada, it’s important to compare credit card offerings from various banks and financial institutions in Canada. Research interest rates, annual fees, rewards programs, and eligibility requirements before making a decision. Consider your creditworthiness and financial goals when choosing the best card.

Navigating the Credit Card Landscape: Building Credit with Popular Canadian Options

Building credit in Canada is essential for unlocking financial opportunities like loans, mortgages, and better insurance rates. But navigating the vast array of credit cards can be overwhelming, especially for those starting their credit journey. This guide explores five popular credit cards in Canada, analyzing their suitability for building credit: American Express Cobalt® Card, Scotiabank Passport® Visa Infinite* Card, TD Cash Back Visa® Card, RBC Cash Back Mastercard®, and HSBC Mastercard Rewards®.

1. American Express Cobalt® Card

TheAmerican Express Cobalt® Card boasts enticing welcome bonuses and high rewards rates for specific categories, but it’s not the best choice for building credit. Here’s why:

- High Annual Fee: This card carries a hefty annual fee. If you’re new to credit or have a limited budget, this fee is worth keeping in mind. But remember that the credit card rebates it offers are amazing.

- Not Reported to All Bureaus: American Express doesn’t report to all credit bureaus in Canada. While they report to Equifax, they might not report to TransUnion, which could limit the impact on your overall credit score, which is why it’s essential that you remain proactive.

2. Scotiabank Passport® Visa Infinite Card

The Scotiabank Passport® Visa Infinite* Card caters to frequent travellers with its airport lounge access and travel insurance benefits. However, for building credit, its advantages may be limited:

- High Annual Fee: Similar to the Cobalt card, this card has a high annual fee, which might not be ideal for those focused on building credit without incurring additional costs. However, if you’re able to manage your spending, it’s one of the best credit cards for building credit in Canada.

- Focus on Travel Perks: The card’s rewards program prioritizes travel benefits over cashback, which might not be suitable for everyday spending and building a consistent credit history through regular transactions.

3. TD Cash Back Visa® Card

The TD Cash Back Visa® Card offers a more balanced approach to building credit and earning rewards:

- No Annual Fee: This card comes with no annual fee, making it a budget-friendly option for building credit without additional costs.

- Cashback Rewards: The card offers a straightforward cashback program on everyday purchases, incentivizing regular spending and building a positive credit history through responsible management. It’s easily one of the best credit cards for building credit in Canada.

4. RBC Cash Back Mastercard® (Similar Benefits to TD Cash Back Visa):

The RBC Cash Back Mastercard® offers features similar to the TD Cash Back Visa®, making it another one of the best credit cards for building credit in Canada:

- No Annual Fee: This card also boasts no annual fee, allowing you to focus on building credit without incurring extra charges.

- Cashback Rewards: With a cashback program on everyday purchases, the card encourages responsible spending that contributes to a positive credit history.

5. HSBC Mastercard Rewards®

The HSBC Mastercard Rewards® might be suitable for those with a lower minimum income requirement compared to other cards:

- Lower Minimum Income Requirement: This card might have a lower minimum income requirement for approval compared to some premium cards. This could be beneficial for those starting their credit journey.

- Rewards Program: While the rewards program might not be as lucrative as some other cards, it can still incentivize responsible spending and build a positive credit history, acting as one of the best credit cards for building credit in Canada.

Choosing the Right Card:

While these cards offer varying benefits, consider these factors when choosing the best credit cards for building credit in Canada:

- Creditworthiness: Your credit history will determine which cards you’re eligible for. Secured cards with lower limits might be a good starting point if you have no credit history or bad credit.

- Spending Habits: Analyze your spending habits. If you travel frequently, a travel rewards card might be appealing once you’ve built some credit history. For everyday needs, a no-fee cashback card is a good choice.

- Financial Goals: Are you aiming to build credit quickly or earn rewards alongside? Prioritize your goals when making a decision.

Remember: Building credit is a marathon, not a sprint. Responsible use is key. Pay your balance in full and on time, keep your credit utilization ratio low, and avoid frequent credit applications.

Building a Stellar Credit Score in Canada: Beyond Choosing the Right Card

While selecting the best credit card for your credit-building goals is crucial, it’s just one piece of the puzzle. Here are some additional tips to help you achieve a stellar credit score in Canada:

- Staggered Credit Limits: Consider applying for two low-limit credit cards from different issuers at separate times (e.g., spaced a few months apart). This can help you build a wider credit history with a good mix of credit products while keeping your overall credit utilization ratio low. However, be mindful of not overloading yourself with credit and ensure you can manage both cards responsibly.

- Explore Secured Cards with Graduation Programs: Some secured credit cards offer “graduation programs” where, after a period of responsible use and on-time payments, the issuer may upgrade you to an unsecured card with a higher limit. This can be a great way to build credit while eventually transitioning to a card with better rewards or perks.

- Monitor Your Credit Report Regularly: It’s essential to monitor your credit report for errors or inaccuracies. You can obtain a free credit report from Equifax and TransUnion twice a year. Dispute any errors promptly to ensure your credit score reflects accurate information.

- Practice Good Financial Habits: Building credit is a lifestyle change, not a quick fix. Develop good financial habits like creating a budget, tracking your spending, and avoiding impulse purchases. Responsible financial management translates to better creditworthiness.

- Consider Secured Credit Cards if Needed: If you have no credit history or bad credit, secured credit cards can be a valuable tool. They require an upfront deposit that serves as your credit limit. Responsible use is reported to credit bureaus, helping you build a positive credit profile.

- Be Patient: Building a strong credit score takes time and consistent effort. Don’t get discouraged if you don’t see immediate results. By following these tips and using your credit card responsibly, you’ll be well on your way to achieving a stellar credit score and unlocking a world of financial opportunities in Canada.

Stretch Your Dollar Further with Great Canadian Rebates!

Tired of missing out on savings? Join Great Canadian Rebates, your one-stop shop for earning cashback on everyday purchases! You can explore our credit card comparisons and find incredible cash back offers and deals, making strategic purchases and choosing cards that align with your needs most effectively.

Sign up today for our program and enjoy cash back and credit card rebates like no other!